HR Payroll Management

HR Payroll Management module, which is powered by Odoo software, is a comprehensive suite of business management software applications designed to help organizations streamline their HR operations. The Odoo HR Payroll Management software module is a comprehensive and integrated solution designed to streamline and automate the HR payroll management process within organizations. Odoo, an open-source enterprise resource planning (ERP) system, offers this module as part of its suite of applications aimed at facilitating various business operations. AppsComp provides the best Odoo HR payroll management software in Coimbatore.

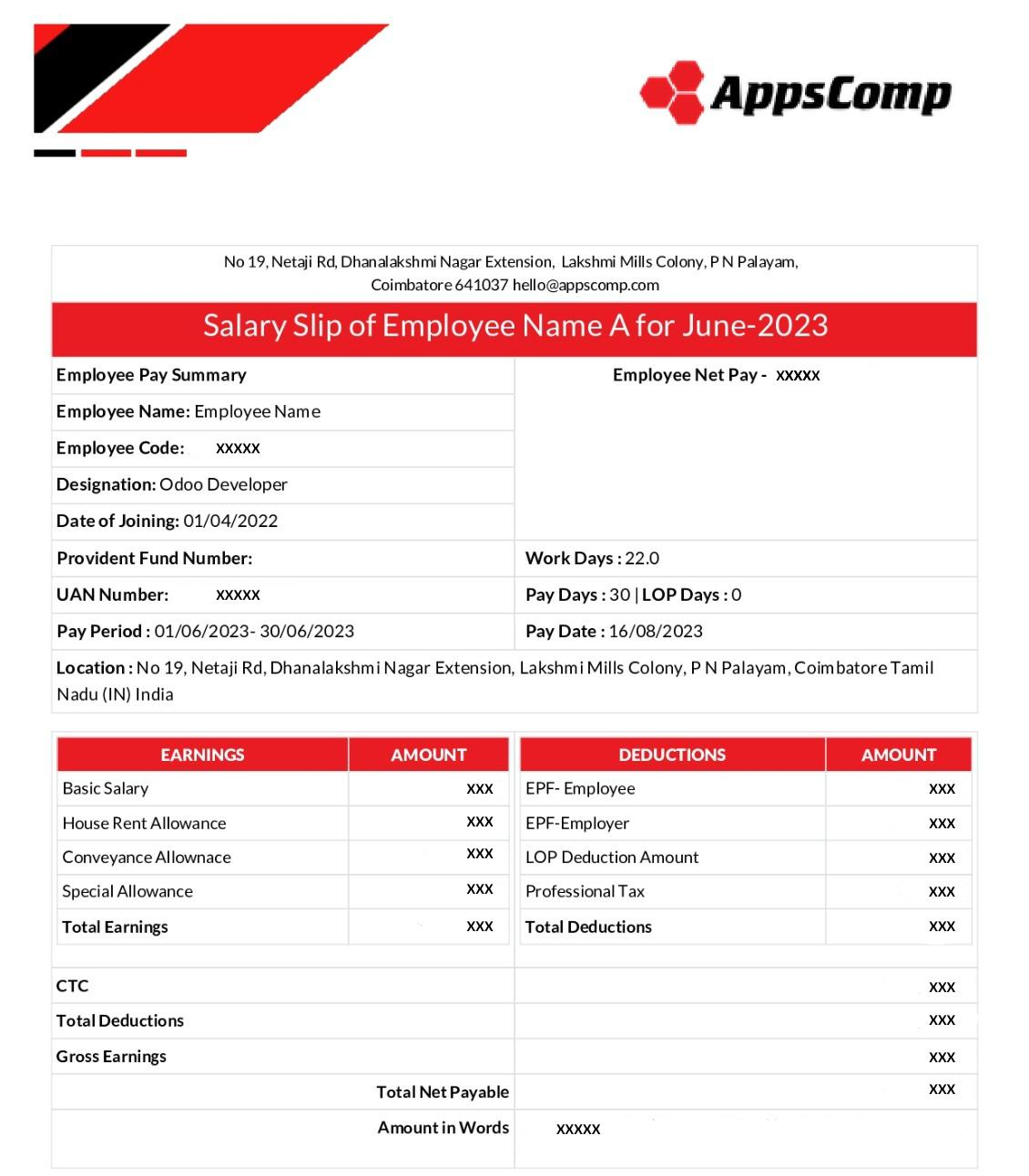

The Odoo HR payroll management module enables businesses to efficiently manage employee compensation, deductions, taxes, and other financial aspects related to payroll. It automates calculations, generates pay slips, and ensures compliance with labor laws and taxation regulations.

We give amazing features

Employee Management:

The HR Payroll module allows you to maintain a comprehensive database of employee information. This includes personal details, job roles, work schedules, tax information, and more. Centralized employee records enable accurate and efficient payroll calculations and ensure compliance with legal and regulatory requirements.

Salary Payment and Disbursement:

Once payroll calculations are complete, the module facilitates the actual disbursement of salaries to employees. It generates pay stubs or salary slips that detail the breakdown of earnings, deductions, and net pay. Integrations with payment systems or methods enable seamless salary transfers.

Payroll Calculation and Processing:

This feature automates the calculation of employee salaries and benefits based on predefined rules and parameters. It considers factors such as working hours, overtime, deductions, allowances, and taxes. Automating payroll calculations reduces manual errors and saves time, especially for organizations with complex pay structures.

Leave and Time-Tracking Integration:

The HR Payroll module often integrates with leave and time tracking features to ensure accurate pay calculations based on attendance, leaves, and absences. This integration helps in calculating variables like paid time off, unpaid leave, and other attendance-related factors.

Tax and Deduction Management:

Odoo’s HR Payroll module helps manage taxes and deductions, including income tax withholding, social security contributions, insurance premiums, and other deductions. You can configure the system to calculate and deduct these amounts accurately from employees' paychecks, ensuring compliance with legal obligations.

Reporting and Compliance:

Reporting is a vital component of payroll management. The module offers various reports that provide insights into payroll expenses, tax liabilities, salary structures, and more. These reports aid in decision-making, auditing, and compliance with labor laws and regulations.